Major Payment Trends Expected to Accelerate in 2023

The payment landscape is undergoing a thrilling transformation in 2023 as major trends gain momentum and propel the industry forward. E-commerce has been trending up for over ten years, and the e-commerce market share is expected to continue to grow in 2023. Between 2021 and 2026, retail e-commerce sales are expected to grow by over 56 percent. By 2026, retail e-commerce sales alone will equal $8.1 trillion worldwide.

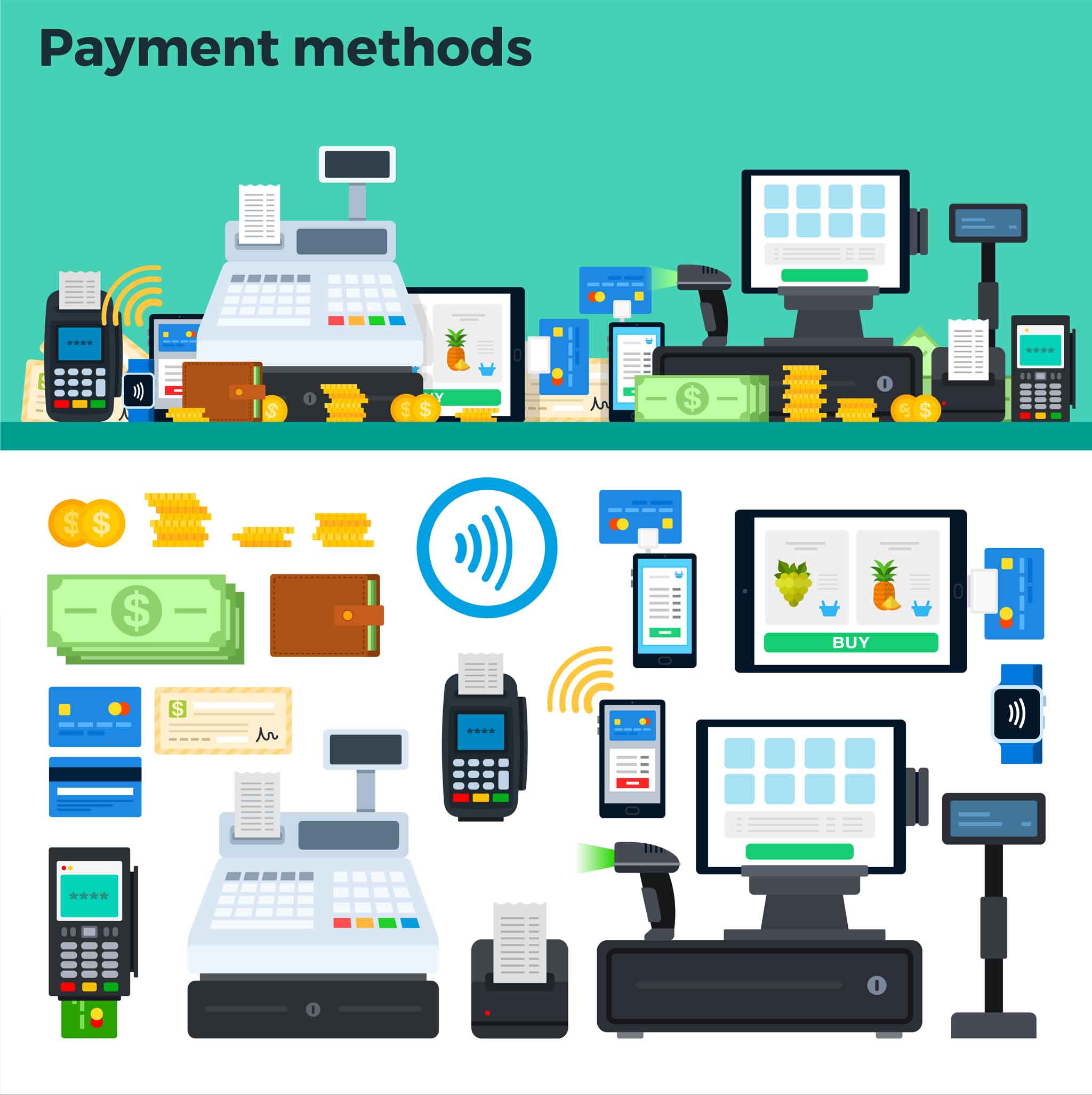

With the rise of e-commerce comes the rise of digital payment solutions. “Digital payments” refers to a number of solutions, including contactless payments, digital wallets, and mobile wallets. The Covid-19 pandemic caused adoption of these technologies to skyrocket, and growth is not expected to stagnate anytime soon.

Top Payment Trends to Watch in 2023

The total transaction value of the digital payments space is anticipated to $9.4 trillion in 2023 reach. Let’s take a look at which trends will be driving this growth.

Digital Wallets

Driven by the Covid-19 epidemic, contactless payment solutions are now prevalent all over the world. Small business owners as well as major retailers now accept payment by mobile phone or through a credit card chip. In fact, 82% of small business owners worldwide have updated their operations to account for contactless payments.

Real-Time Payments

Real-time payments (RTP), or the ability to digitally send money to another person immediately, and on demand, are poised to become a larger payment strategy in 2023. Beyond simply peer-to-peer payments through apps like PayPal and Venmo, RTP is fast becoming the de-facto way of paying gig workers and workers in underbanked societies.

Payment Technologies

Digital identity technologies are in large part responsible for driving the boom in digital payments. The rapid improvement of technologies like retina scanning, facial recognition and biometric analysis has lead to increased confidence in digital payment solutions, and driven adoption of digital payment technologies.

Another key factor in the rise of digital payments is the rise of APIs and microservice architecture. APIs that support the development of payment apps and digital currencies are now commonplace, and payment APIs will continue to underpin the development of new apps and solutions in the coming years.

Trends Expected to Decrease

Although next-generation currencies have been on the rise for the last ten years, some analysts speculate that we may have finally seen the end of the cryptocurrency boom. However, others posit that increased government regulation could lead to wider adoption.

The cryptocurrency market started 2023 strong, but it remains to be seen whether this is a sign of better times to come, or simply a bear market rally after disastrous 2022.